Some deliveries may take a little longer than usual due to regional shipping conditions.

معلومات عنا

حقوق الطبع والنشر © 2024 Desertcart Holdings Limited

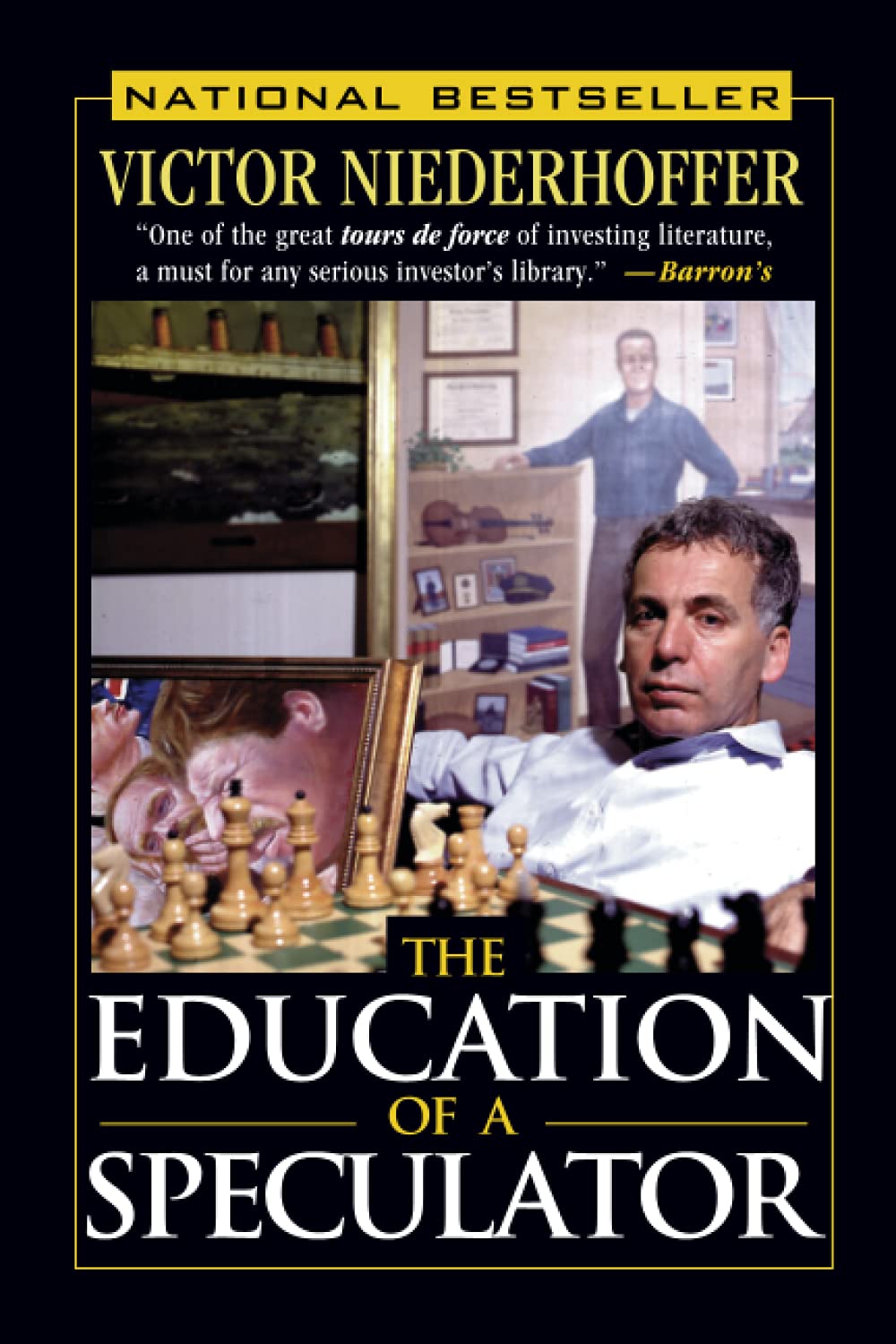

The Education of a Speculator

A**R

A lot of wisdom here.. not quantitative and that is the point: Focus on the concepts

I am not sure I agree with the majority of the sentiment here. It was not supposed to be a quantitative book and he even states that right off the bat. I am a professional financial programmer, so I can see where everyone is coming from.However, I think you risk missing the forest for the trees. He offers many (emphasis) helpful tidbits on how to start your own analysis. The author's axioms that I took away were as follows:1.) Don't believe what is publicly held belief: you need to find where the probabilities are understated in order to make profit in the game2.) A lot of it is luck and you cannot fight the marketplace too much.. this always tempts speculators. I believe that he ultimately wiped out this way. *You have relatively no control, so pick a "good setup" that your analytics say is undervalued and then "let go" while still managing your downside risk. *Why rolling your own here is SUPER important. I believe it is impossible to find this using public models unless you significantly tweak them with new (statistically based) concepts. -of course, purely academic models are the worst. You at least need to shock and "stress test" the assumptions across time and for parameter changes.3.) Test test test more. Test theories of what you think is happening and do it statistically (emphasis) where you get an actual number versus "this looks good" Use PDF and CDF but know when it goes out of sample and breaks. Use different distributions and know that still at the end of the day, all you are doing is flipping coins unless you are arbing with lots of fixed income under everything. *Systems break from time to time, so that is not the be all end all. Still need to know when to use cunning, intuition, and shut it off *Manage the downside risk and let the upside run randomly?4.) (mild one) Learn how to program in an assembly language *big caveat- in finance, computers might really not be all that much. That being said, given two people with equal connections, the one that mitigates risk better using a computer system would probably win. "Probably" is a big if since it is really tough to use computers here in a live framework and not have something break.Of course, he is not and cannot do all the work for us because it requires pages and pages of even simple statistical ANOVA or something similar time series analysis, then cunning, timing, connections, and personal preference. You will never build that into a book. Many sources need to be read and it seems to me like something that is earned.5.) Never give up in a search for a potential solution. There is probably more than one like anything with some being easier than others.6.) Unlearn everything from ivory tower schooling and/or standardized testing:7.) Every day and in every way, still admit to yourself that you really know relatively little to nothing. Embrace randomness but have the guts to strive for learning and defining the unknown like a scientist (although it is impossible anyway). :)-------------------------------------------------------------------------------------------------------------I guess I would suggest that if you really want to learn quantitative stuff look at:1.) Single linear regression, ANOVA, F, and P test. Chi square of significance for parameters you are testing. Know how to derive each BY HAND (emphasis) and then program them all into a real time framework-**even if you do not recognize the math at first, keep at it and stick with it *Most people don't even know single variable regression/ how to derive or that F test and p from that is more valuable than R^2 fit2.) which brings up the next point: time series/learn time series math- This will most likely involve -vector calculus -multivariate stuff: little tidbits like a linear multivariate predictor can be expressed in a 3d plane with a spot for each predictor on each axis and then you track the obs versus expected *Sometimes here the super super old books you can get for $2 are the best. They are super intense in a math sense, but you will earn it. *Time series stat tests on these R squared, p and F values. So here is where interface programming helps a lot2B.) Managing databasing and multi-sharding at this time gets crazy. Need different threads to process the raw data so doesn't lock main computer.3.) Some kind of binning of real time news or a news database: then bin those around "large jump events" and see if you can separate anything out. (I'm still not remotely close here I must admit) -Web crawler integrated?4.) Integrate Excel live w/ interop (has many issues/ need to lock down cell ranges) and integrate strategies live like R and Matlab (R.NET/ matlab dll).5.) "Roll your own excel in .NET (datagridview). Is painful and hard to get formula support. Sometimes just the data in an editable grid is nice enough imo6.) My rule and partially his from what I have surmised: Anyone can calculate a formula or a say black-scholes PDE/CDF. There is little to no value in basic calculations if everyone can do that. It is just meant to be a starting point to valuation and no one can perfectly quantify (or even almost acceptably) quantify reward and have it mean something useful using calculations like these without intuition and judgement while tweaking and knowing the models.The real time framework is a real pain especially if you are "rolling it all yourself." I am at the point where I am building tools, and I am going to need to cross the machine boundary to another server computer system.. and all this to prove out something that might not work. Btw I can move into anything, but I find myself often focused on "undervalued" / "misvalued" options with my own proprietary probability models and different signaling filters based on different distributions.So yeah, if anyone would like a list of books I have looked at (quite extensive at this point) just shoot me an email I guess to [email protected]. But yeah, all my work applied and still just have the basic tools and an idea of where I need to go. My advice (I wish I could take it as well but I never will haha) is to avoid the game at all costs. I mean look, he and others are among the best and they still wiped out. No one knows the future.. I can't wait to read his other book though for sure.If he imploded and was kind enough to publish it, I think we should all be wise enough to learn something from it (and wiser than me by never starting)..-Mike P. Sopko

C**R

Our Generations Reminisences of a Stock Operator

Much like Jesse Livermore, Victor Niederhoffer speculates in the market using a form of intuition, vigorous study, and a lot of leverage. Risk management doesn't seem to be in his vocabulary, though he does seem to reccomend it. This book reads like a wonderful memoir should read, insightful into the life of a man, with the focus on how that life led the man into his profession. I frankly found the writing to be full of energy, action filled, poweful, had he not gone to become a speculator, he probably would've been a novelist of some sorts. There's some argument on the reviews of the quality of the man and his advice, since he did bust out, lose the money in his fund, and have to leverage everything to recover, but he is back in the swing a of it now. However, I think that's all beside the point.Victor Niederhoffer is a man who likes the challenge and is a contrarian by nature, it makes him act against he market, and steam forward with no stopping. Is it a great way of trading, if you don't mind an early trip of the grave from a heart attack, maybe. But that's not the point of this book. The point of this book isn't to teach you how to trade, he says that right from the book, but to give insight into what he took from his life, what he does when he goes into a trade, and what he does when he's winning and losing. This wasn't a book that gae you a trategy, it was a book about one man's education that could be any man's education, and how he uses it to amass wealth in the markets.Like Reminiscences of a Stock Operator, the story focuses on his journey, on his mistakes, on his victories, on the moments of elation and the moments of absolute dread. It's a fun, interesting read, not too long, so if you like the financial world, you may certainly enjoy this one, since it's cast of characters is both interesting and fun to enjoy. And, if you pay attention, and take it in, you might be able to learn from his mistakes, and get a few lessons as well from it.

L**T

Interesting and Entertaining Book

The anecdotes are good and there are some good life lessons. I don't agree with his ideas about investing, though.

V**N

Decent read..but if you're looking for stuff on trading psychology, Brett Steenbarger is far better

Decent read, though it reduces to a drag from time to time. Its easy to skip over those sections without losing flow.There are far better books on trading psychology by Brett Steenbarger.

D**E

For a friend. He is serious about stock market.

For a friend. He is serious about the stock market. He really likes it.

P**X

semble tel qu'un neuf1e.

Des examples vrai pour réussir Merci.

M**I

Nothing interesting

Lots of stories unrelated to markets, economy, and speculation

A**R

One of the great investment books

A must read for investors and traders.

Y**M

V. Niederhofferの自伝的な書籍

20年前のNHKのドキュメンタリー「マネー革命」で登場したMr. Niederhoffer。彼の生い立ちや、経験について本書で書かれている。私自身は「楽譜の出てくる経済論」というものが気になって本書を購入したわけだが。成程…意味不明。恐らく楽譜における"感情"の変化と、市場における"感情"の変化の部分がNiederhoffer氏にとっては気になったんじゃないかなと思います。切り口としては面白いと思いますが…。他の部分は冗長で読みずらかったです。私は読み切れませんでした…。

M**N

Five Stars

Fantastic tale of a speculator...something to learn no matter what trading experience. Received promptly.

ترست بايلوت

منذ شهرين

منذ 3 أسابيع