معلومات عنا

دعم العملاء

احصل على التطبيق

قم بتوجيه الكاميرا لتنزيل التطبيق

حقوق الطبع والنشر © 2024 Desertcart Holdings Limited

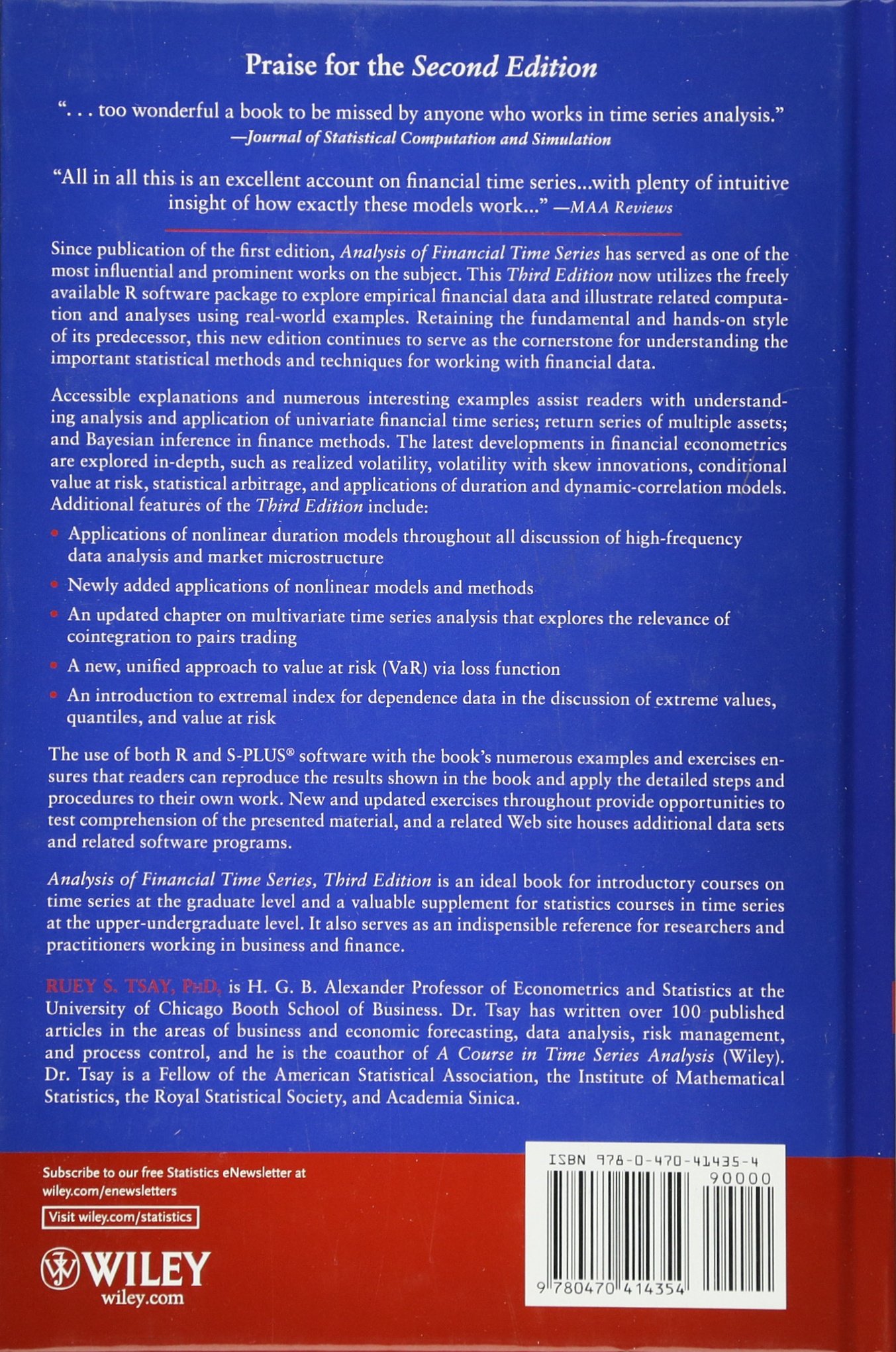

Analysis of Financial Time Series

D**G

Fantastic text

Tsay does an outstanding job taking commonly taught time series concepts and explaining them in a different way. He starts with review of the basics i.e., distributions, moments, processes, stationarity. He covers the functional form and properties of AR, MA, and ARMA models, as well as non-stationary processes (random walk), trend-stationary processes, unit-root tests (Dickey-Fuller), autocorrelation tests (Ljung Box), and seasonality. He naturally transitions into conditional hereoskedasticity models (ARCH/GARCH) and the many special cases (EGARCH/IGARCH/TGARCH/Stochastic vol.). He has a great section on nonlinear models, focusing on threshold and smooth transition AR models, Markov switching models, non-parametric models (kernel regression), and state-space models.His section on big/high-frequency data and market microstructure should be required reading. He covers nonsynchronous trading (and how it may induce serial or cross-correlation), bid-ask bounce, duration models, and the Eps effect.The section on continuous-time stochastic processes is extremely clear (more than other texts). It explains the Wiener process, Ito process (and Ito's lemma), the Black Scholes Merton differential equation, the Black Scholes Merton pricing formula (risk-neutral proof), and jump-diffusion models.Tsay also includes an entire section on Value at Risk (parametric, historical, econometric), extreme value theory (Generalized Pareto and Peaks-over-thresholds), and the extremal index.Multivariate topics are covered, including vector autoregression (with Cholesky regularization), vector moving average, vector ARMA, cointegration, cointegrated VAR, vector error correction, and threshold cointegration. Multivariate volatility models are also mentioned, including multivariate GARCH and BEKK model.He explains principal component analysis in connection with factor models, including the Barra factor model and the Fama-French model. He also goes deeper into state space models, giving a full explanation of the local trend model and deriving the Kalman filter (as well as smoothing algorithms). At the end of the text, he has some advanced approaches to dealing with missing values and outliers, giving a brief overview of Bayesian inference and Markov chain Monte Carlo (Gibbs, Metropolis-Hastings, Griddy gibbs, etc.). He includes Monte Carlo applications, such as Markov switching and stochastic volatility models.

D**S

Effective simple to follow introduction and competent review of the field

I found the book especially simple as an introduction to the field. But it also goes sufficiently deep and robust for students and readers interested in more detailed treatment. The R, S-Plus and other software demostrations are very useful tools to launch the student into his own use of these tools for specific research.

D**S

A nice up-to-date collection of time series techniques

A nice up-to-date collection of time series techniques. Should be useful for someone who already has some experience in the field. However, would not recommend as an introduction for an uninitiated.Pros:* Covers a broad scope of up-to-date time series topics.* Presentations of models are concise but not too short.Cons:* A bit uncomfortable and unconventional (compared to other time series texts) notation.* On some occasions presents outdated approaches that have been proved "wrong" without even giving a warning. E.g. suggests testing for remaining ARCH effects in (G)ARCH model residuals by the simple ARCH-LM test. This approach has been proven wrong and an alternative has been suggested already in 1994 (the Li-Mak test). However, the book is completely mute about this issue.* A few typos, but not a major problem.

G**N

Very good practical book

It's very good to see the demonstration of the examples are all in R or S-plus in this edition. The book is particular using the Rmetrics series packages as the sources of time series analysis, and the website of the book tells you which particular package you need for the topic of the time series and this definitely reduces the time of looking for packages in R for the analysis. As I just got the book, if any further comments, I will post here.

S**W

Well Explained Book

Very well explained book. Also attached branch of examples with R studio codes.

R**E

Five Stars

If you are in the industry of math finance. This is the must-read book in time series.

M**A

Two Stars

this is a very difficiult book to read

M**M

the best reading on the subject of time series

very technical and detailed contents for those in the industry, the best reading on the subject of time series!

ترست بايلوت

منذ شهر

منذ 3 أيام